The Super Sale 6.6 event period marked the beginning of the year-end shopping season on E-commerce platforms. This year, many brands and industries immediately saw a surge in sales on the platforms in June. YouNet ECI Ranking – the ranking of the best-selling brands on E-commerce, also noted several noteworthy movements.

Top 10 best-selling brands across various industries on E-commerce:

Brands from 9 different product categories were ranked by YouNet Ecommerce Intelligence based on the Gross Merchandise Value data collected daily from over 24,000 active shops on the Shopee, Lazada, and Tiki platforms.

YouNet ECI processed this large dataset using AI technology combined with industry expertise to calculate the revenue and market share of each product line and brand. YouNet ECI’s AI technology can also detect and exclude cases of gift-with-purchase, abnormal data, or fraud to provide the most accurate indicators for purchasing power.

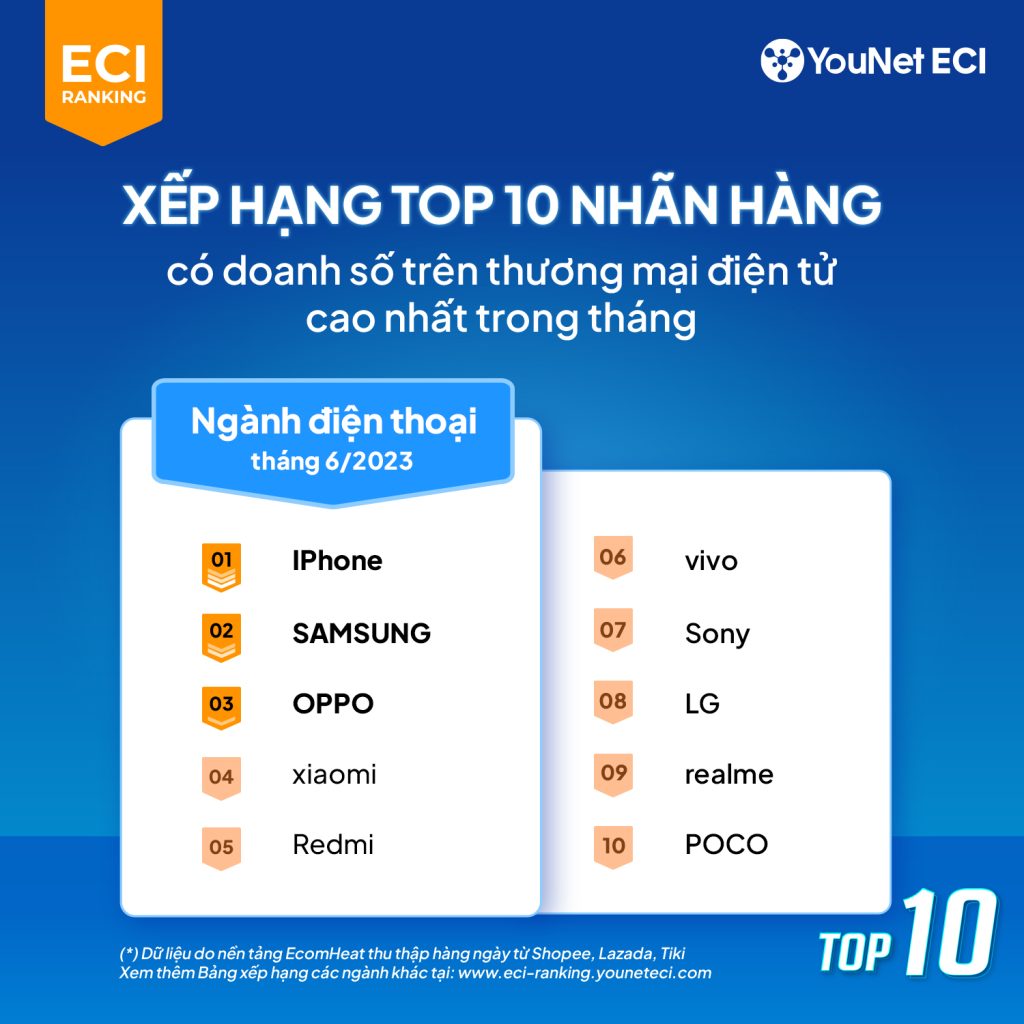

Mobile Phone Category: Revenue jumped by 109%, iPhone regained the top spot from Samsung

In June, several iPhone models recorded a significant increase in sales. The iPhone 14 Pro Max and iPhone 14 Pro saw a sales increase of 114% and 156%, respectively, on E-commerce platforms. The iPhone 14 Pro Max also remained the highest-grossing mobile phone on E-commerce platforms in June. According to YouNet ECI, this positive result was due to sellers pushing sales to clear stock before the launch of the iPhone 15 in September.

As a result, iPhone’s revenue increased by 109% and reclaimed the top position in the market share of the mobile phone industry after losing it to Samsung in May. Following iPhone, Samsung also saw a 39% increase in E-commerce revenue, with the SAMSUNG Galaxy S23 Ultra being the best-selling model.

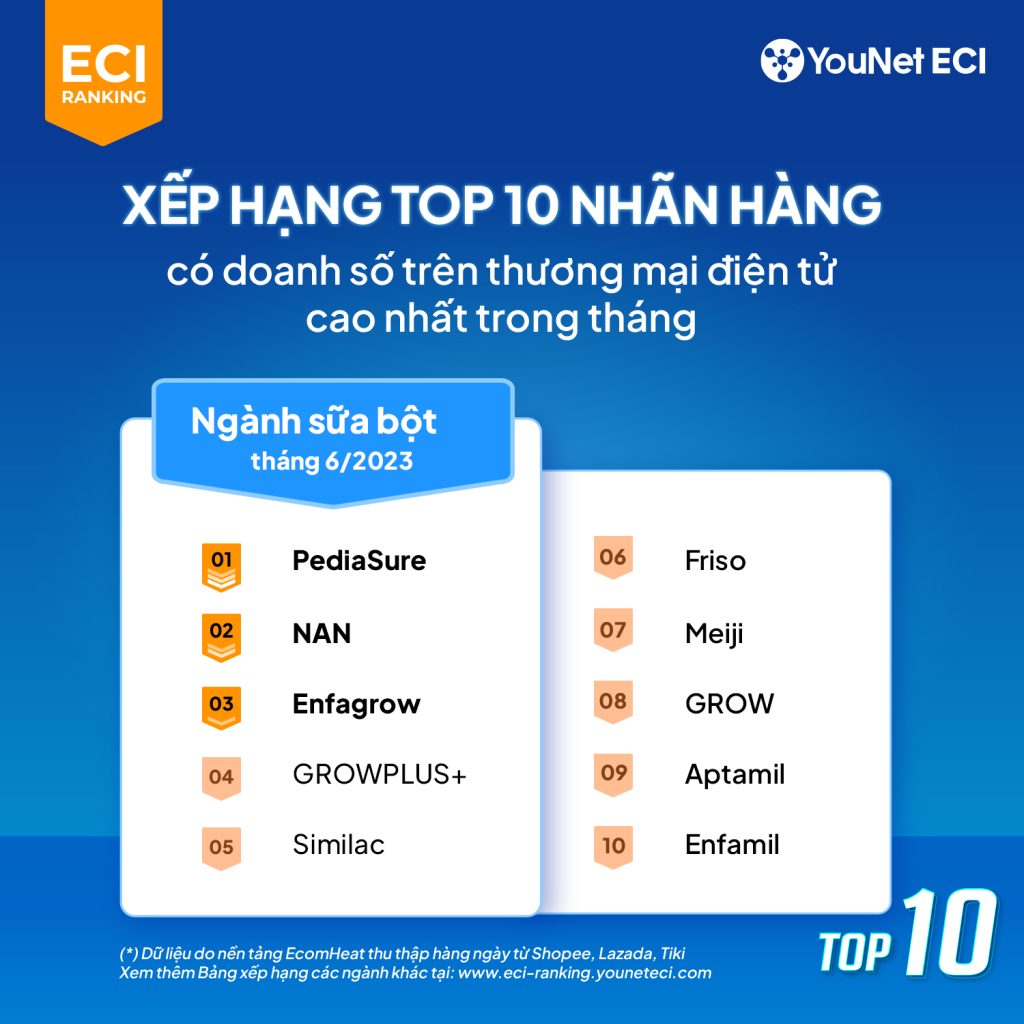

Baby Milk Powder Category: Pediasure maintains 1st place, NAN climbed to 2nd with a 46% revenue increase

Pediasure continues to hold the top position in the market share of the baby formula category. However, there has been a change in the next position: NAN’s GMV increased by 46% in June, moving it from 4th to 2nd place in market share.

The most significant contributions to NAN’s growth in June came from NAN Optipro Plus 4 and NAN Optipro Plus 2 product variants, accounting for 28.3% and 10.3% of NAN’s total GMV in June, respectively. Following these two names, Enfagrow and GROWPLUS+ also had a positive June with revenue growth of 15% and 72%, respectively.

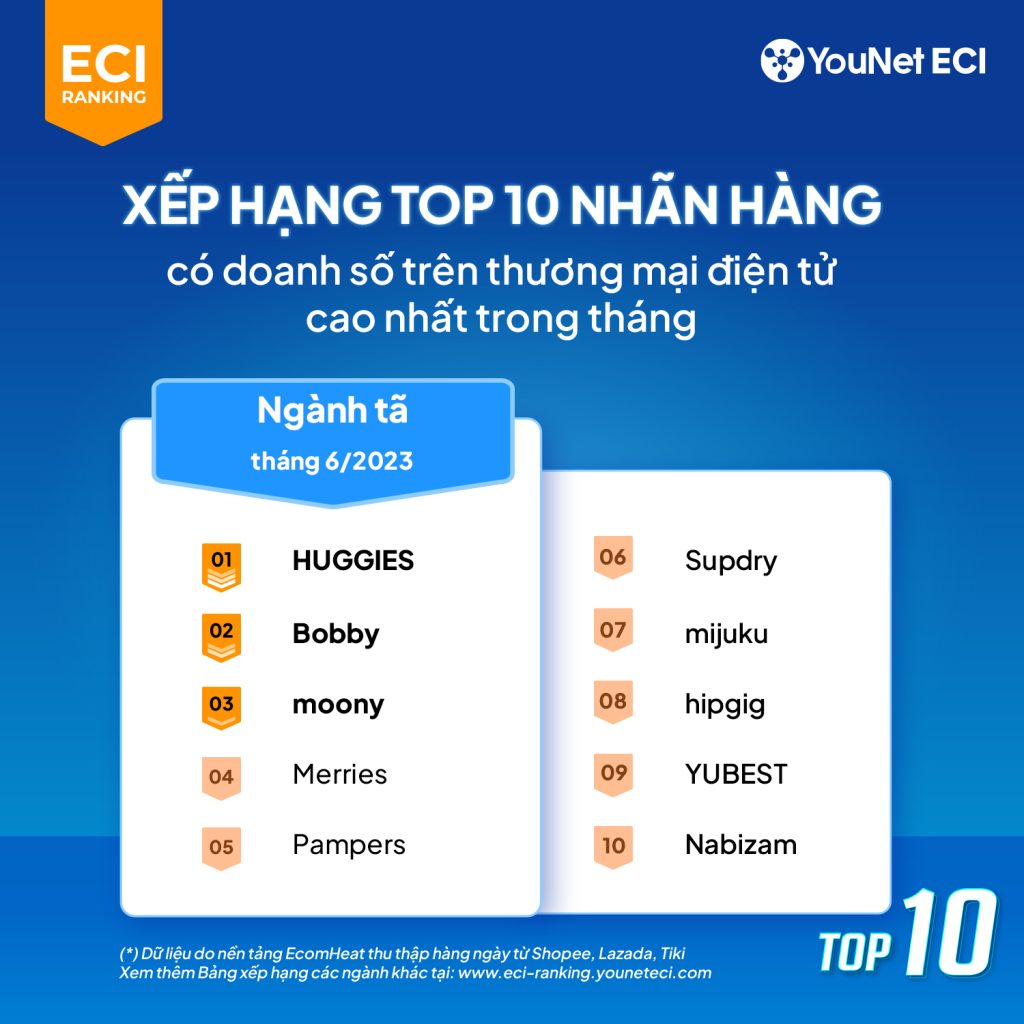

Baby Diaper Category: Huggies, Bobby, Moony recover growth momentum thanks to 6.6

After two consecutive months of declining total GMV on E-commerce platforms, brands in the baby diaper category made good use of the 6.6 shopping event to regain growth in revenue. Specifically, 9 out of the top 10 brands recorded higher GMV in June compared to the previous month, with Huggies, Bobby, and Moony leading the pack with revenue increases of 32%, 20%, and 14%, respectively.

The leading factor for the growth of these brands was the official shops, which saw a 21% increase in GMV compared to May.

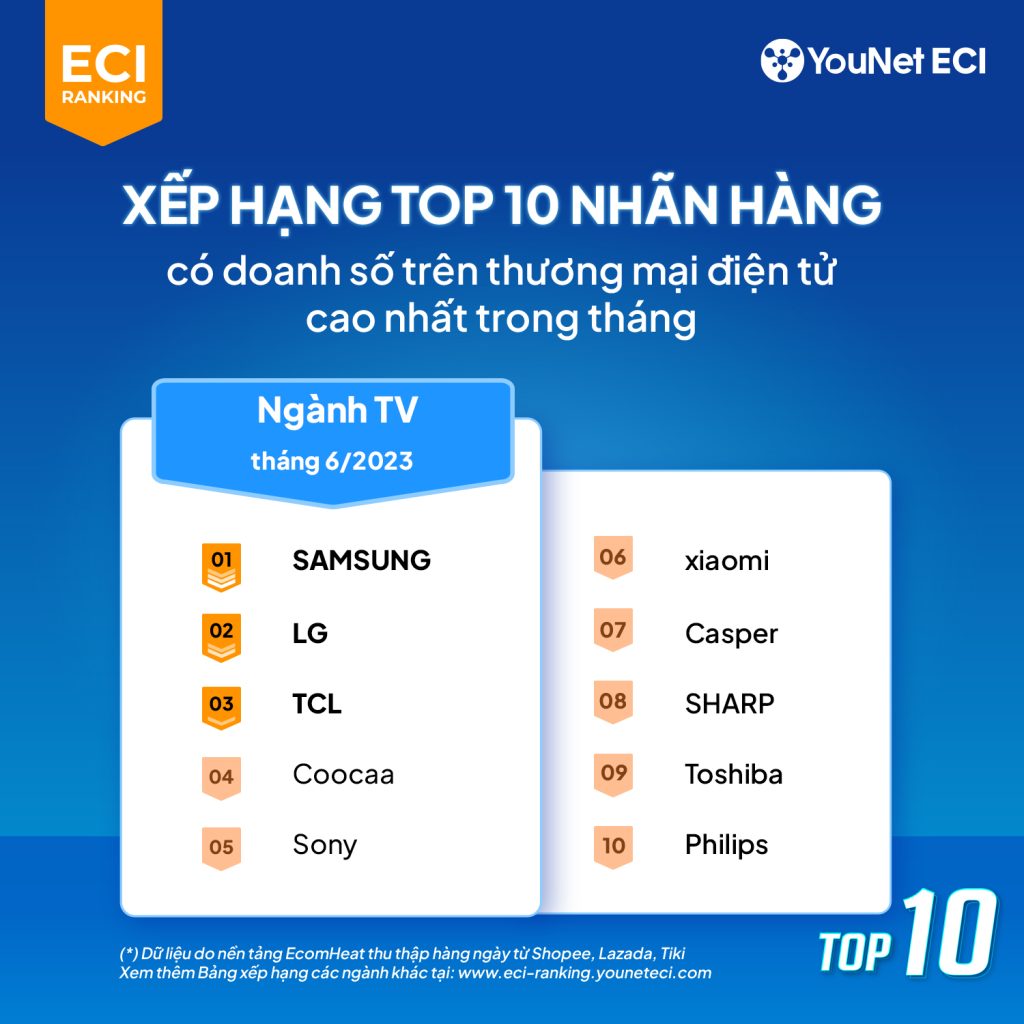

TV Category: TCL surprisingly increased GMV by over 100%

In contrast to other categories, the TV category witnessed strong growth among lower-ranked brands, while top brands like Samsung and LG saw a slight decrease in GMV compared to May.

Among them, TCL stood out the most. The TV brand increased its GMV by 101% in June, moving from 5th to 3rd place in the market share of GMV in the TV industry. Similarly, Coocaa, Xiaomi, and Casper also saw revenue increases of 52%, 32%, and 55%, respectively, compared to May.

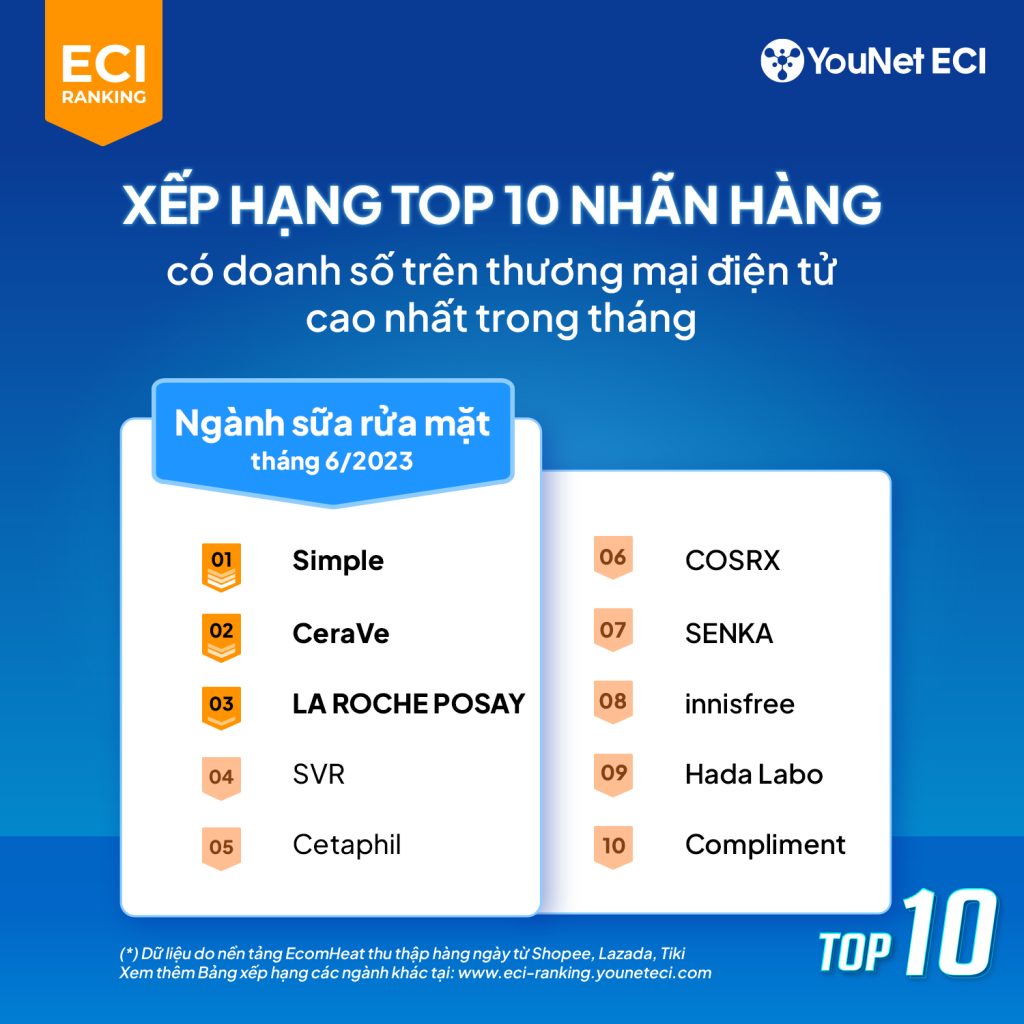

Facial Cleanser Category: Top 5 brands all see double-digit GMV growth

As evidence of the effectiveness of the brands’ promotional activities in June, all 5 top brands in the facial cleanser category – Simple, CeraVe, La Roche-Posay, SVR, and Cetaphil – experienced double-digit GMV growth.

This category is dominated by official shops, which accounted for 62.8% of the GMV in June. This trend reflects the shopping habits of consumers who increasingly prefer shopping at Mall shops.

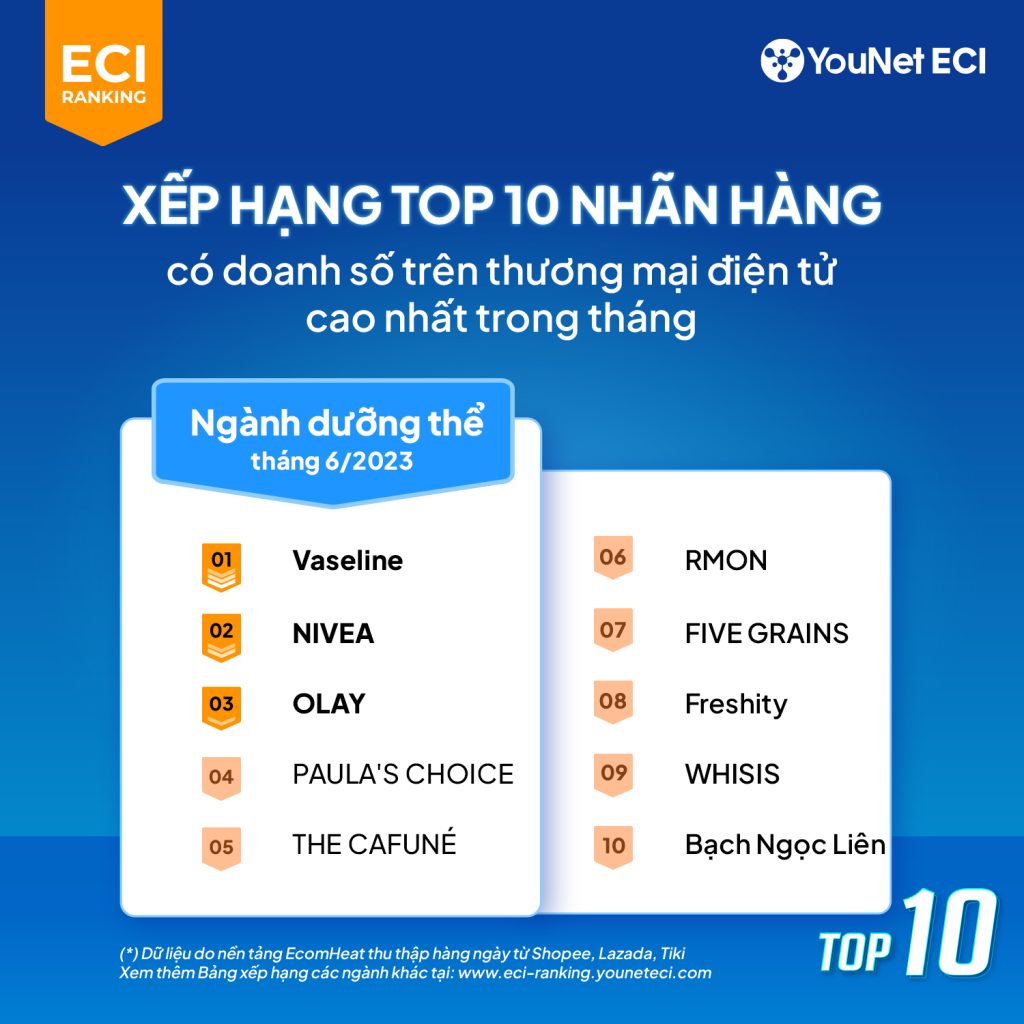

Body Moist Category: NIVEA increased revenue by 38%, climbed to 2nd place

The top 3 brands in the Body Moist Category in June were Vaseline, NIVEA, and OLAY. All three brands saw impressive GMV growth of over 30% due to the promotional activities during the month.

While the majority of Vaseline and NIVEA’s revenue came from official brand shops on Shopee Mall, OLAY did not have an official brand shop on any platforms. OLAY’s revenue mainly came from unofficial sellers.

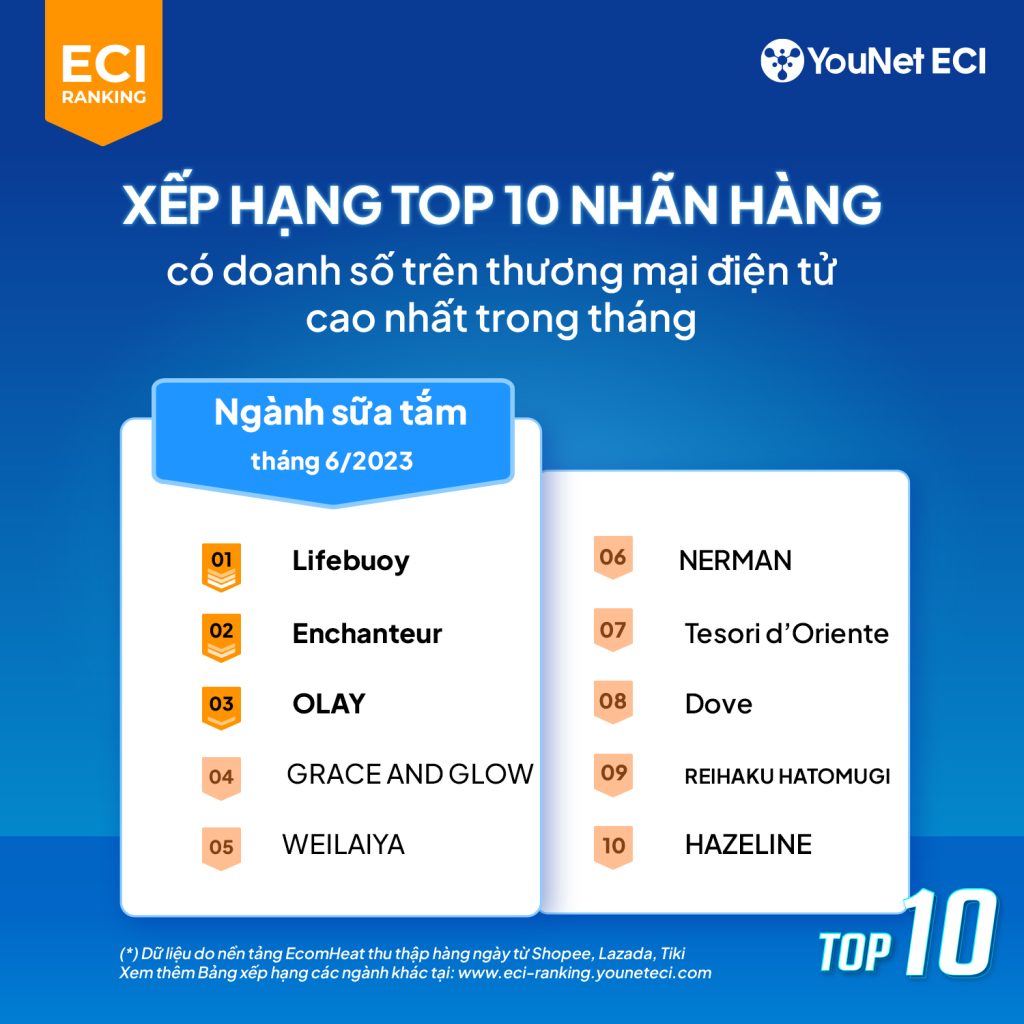

Shower Gel Category: WEILAIYA jumped 5 places to enter the top 5

Among the 9 categories in the YouNet ECI Ranking for June, Shower Gel had the second-highest GMV growth (after Mobile Phone category) with a growth rate of 20%.

Reflecting this positive trend, all 10 Shower Gel brands in the ranking saw increased revenue compared to May. Among them, GRACE AND GLOW and WEILAIYA stood out with GMV increases of 58% and 119%, respectively. Lifebuoy remained at the top of the ranking with a 9.6% market share.

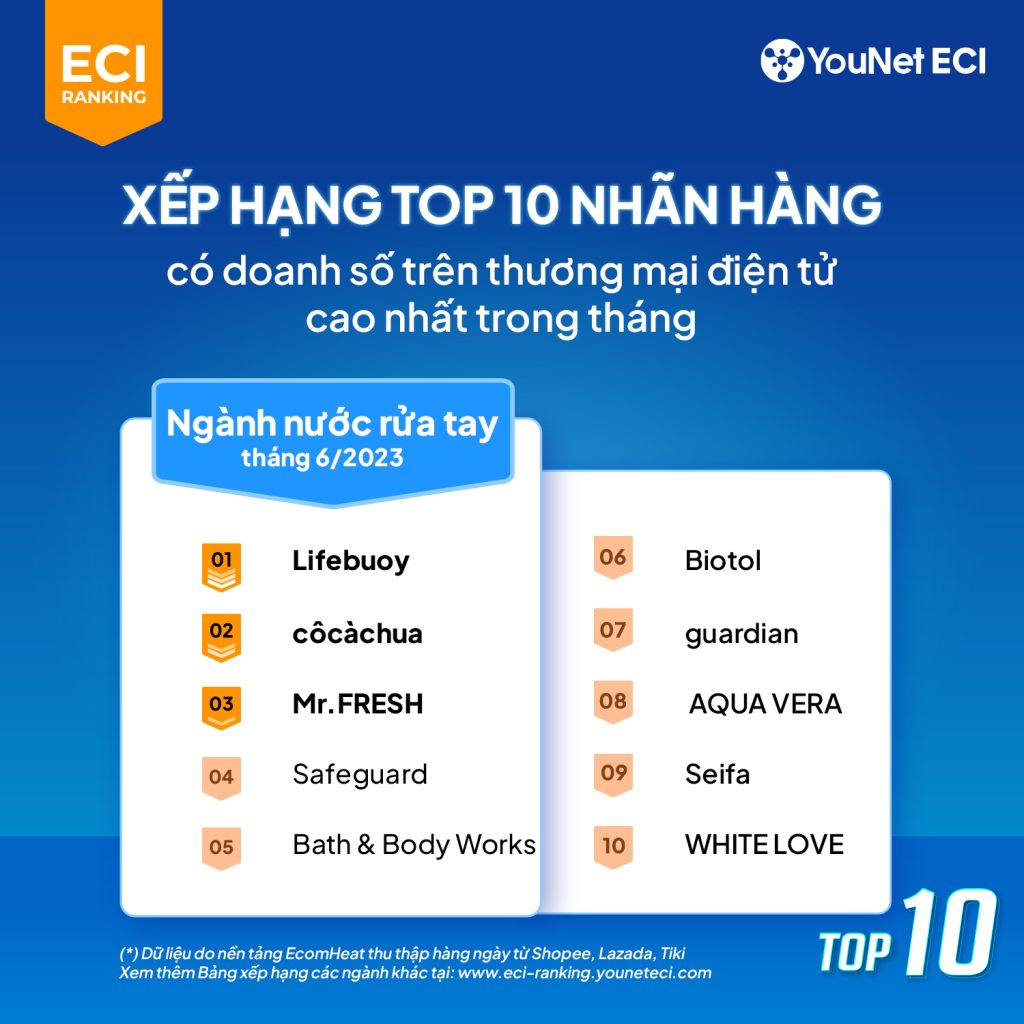

Hand Wash Category: Cô Cà Chua increased revenue by 191%, reached 2nd place in market share

Lifebuoy continues to hold the number one position in the Hand Wash ranking on E-commerce platforms with nearly 60% market share GMV in June. However, the GMV of this brand decreased slightly by 12%. Meanwhile, the newcomer Cô Cà Chua made an impressive leap by increasing its GMV by 191% and climbing to the 2nd place in the category. Nevertheless, Cô Cà Chua currently holds only about 4.4% market share.

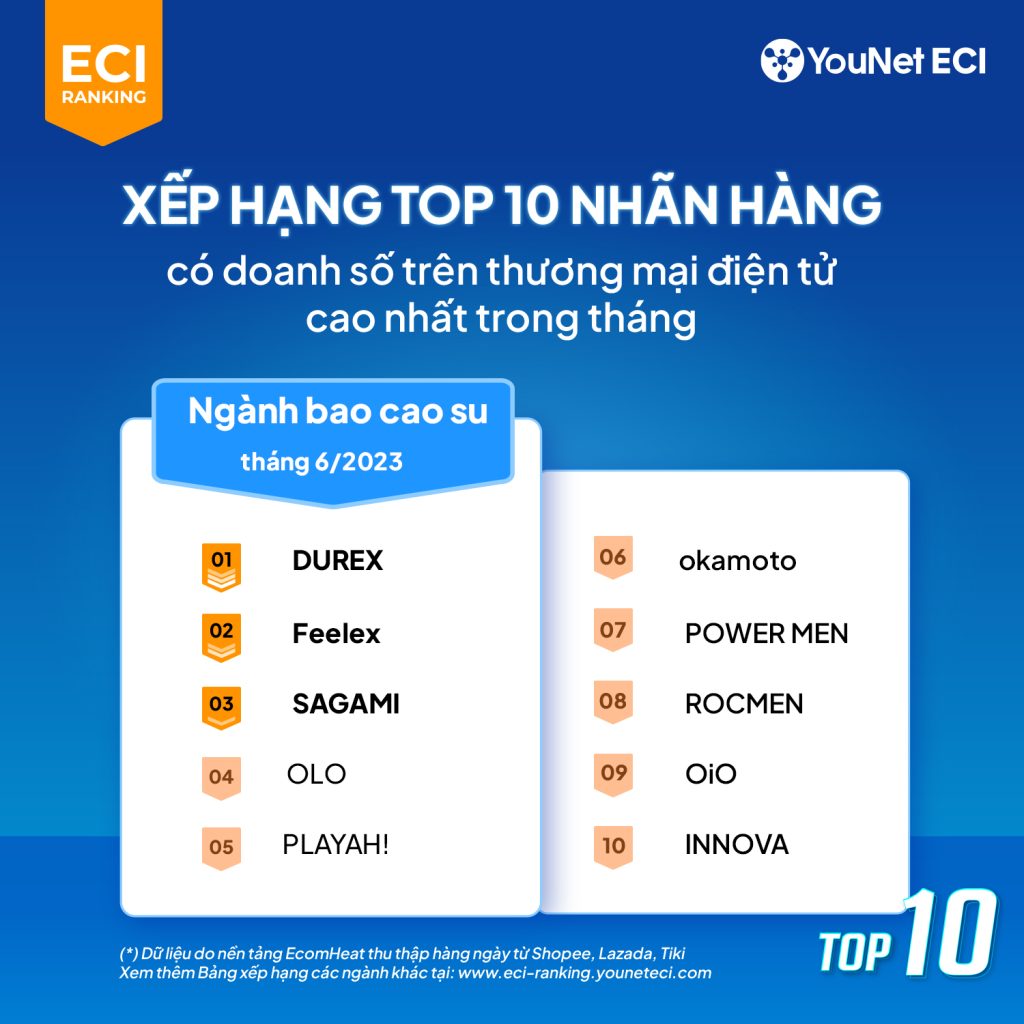

Condom Category: DUREX maintains a firm 39.3% market share

The Condom category did not witness significant revenue growth. The YouNet ECI Ranking for the Condom category in June remained unchanged compared to May, with Durex holding the top position despite the stagnant GMV growth of the brand.

View the full rankings of top brands and top-selling products here.

Introduction to the ranking method:

YouNet ECI utilizes EcomHeat – an E-commerce data collection and analysis platform to monitor the revenue growth and movement of brands and industries on the largest E-commerce platforms in Vietnam: Shopee, Lazada, and Tiki.

The sales revenue of brands is calculated based on the Gross Merchandise Value (GMV) across the Shopee, Lazada, and Tiki platforms, including both Official and Non-official shops.

The YouNet ECI Ranking is regularly announced on the 15th-17th of each month.