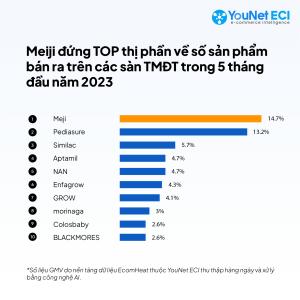

In the first 5 months of 2023, Meiji emerged as the best-selling brand of infant formula on Vietnamese e-commerce platforms, capturing a 14.7% market share of infant formula items sold on Shopee, Lazada, and Tiki (according to YouNet ECI, an e-commerce data analytics company). In the fiercely competitive landscape, what secrets are helping Meiji gain an edge over its major competitors?

Nội dung chính

I. Brand Revenue Analysis: Bucking the Trend

-

Research Context:

Meiji is an imported Japanese infant formula brand with a century-long history. Rooted in Japanese technology, Meiji is committed to providing customers with nutritionally formulaic products that closely resemble natural breast milk.

Data from the EcomHeat e-commerce data platform by YouNet ECI reveals that in the first 5 months of 2023, Meiji secured the top spot in the Infant Formula market in terms of consumption on Shopee, Lazada, and Tiki, holding a 14.7% market share. In terms of GMV (Gross Merchandise Value), Meiji commands an 8.7% market share, ranking second only to PediaSure.

In the first 5 months of 2023, Meiji secured the top spot in the Infant Formula market in terms of consumption on Shopee, Lazada, and Tiki.

In Vietnam, Meiji is distributed exclusively by MagicWave Joint Stock Company. On e-commerce platforms, MagicWave currently manages two official Meiji stores on Shopee Mall and LazMall.

Furthermore, Meiji is also distributed by over 368 stores, both mall and regular, across e-commerce platforms like Shopee, Lazada, and Tiki. Leveraging daily data processing and analysis from these 368 stores, the e-commerce data analysis firm, YouNet Ecommerce Intelligence (YouNet ECI), paints a portrait of Meiji and answers critical questions: What are the success secrets driving this brand on online channels? Are there any lessons for other businesses to take from Meiji?

-

Stable Revenue Thanks to a Robust Unofficial Distribution Network:

In the general context of the infant formula category, sales on e-commerce platforms often fluctuate significantly during major Super Sale events.

Utilizing data from the EcomHeat platform, YouNet ECI conducted an analysis and discovered that Meiji is one of the brands least affected by Super Sale events on e-commerce platforms. In fact, during weeks without Super Sale events, Meiji not only maintains its market share but even increases it.

Specifically, in the third week of February of this year, while the entire infant formula category witnessed a 29.8% decrease in sales compared to the previous week (which coincided with a Super Sale event), Meiji only experienced a 9.6% decline in sales volume, and its market share increased from 12.1% to 13.4%.

Similarly, in the third week of April, when infant formula sales on e-commerce platforms dropped by 37% compared to the second week of April, Meiji recorded a 13.3% increase in sales volume, and its market share rose from 6.6% to 12.2%.

YouNet ECI discovered that during weeks without Super Sale events, Meiji not only maintains its market share but even increases it.

Upon delving deeper into the distribution channel data, YouNet ECI identified a key factor that helps Meiji maintain relatively stable sales: a robust unofficial distribution network.

Specifically, in the first five months of 2023, according to YouNet ECI, up to 95% of Meiji’s sales on Shopee were attributed to retailers and unofficial stores, i.e., stores not directly affiliated with Meiji. This percentage is significantly higher than the industry average of 72% for other infant formula brands on Shopee.

Furthermore, Meiji’s distribution network on the platform not only excels in quantity but also in quality. Among the top 20 stores on Shopee that sell the most Meiji products, 12 of them rank among the top 100 best-selling stores in the industry, with 18 stores achieving “Favorite” or “Favorite+” status.

Thanks to its extensive and diverse distribution network, with less reliance on a few official stores, Meiji can reach broader consumer segments and markets than many other brands, reducing its dependency on specific Super Sale events.

-

Attracting New Customers with Cube Milk Products:

Leveraging a data processing approach that combines AI with a team of industry research experts, YouNet ECI has the ability to analyze the revenue and pricing strategies of brands by specific product lines, product variants, and segments.

According to the analysis, 63% of Meiji’s sales volume consists of products designed for children under 12 months old, with the Meiji Infant Formula line alone accounting for 96.6% of the sales volume.

Particularly noteworthy is Meiji’s introduction of cube milk packaging in Vietnam since 2016 called EzCube. This format involves compressing milk into sticks and packaging them in boxes. When used, mothers simply need to pour the milk into water, eliminating the need for spoons or any other utensils.

Cube milk packaging currently contributes to 85.5% of the sales volume of the Meiji Infant Formula line, equivalent to 52% of Meiji’s total sales volume on e-commerce platforms in the first five months of 2023.

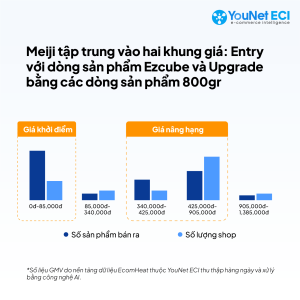

An advantage of cube packaging is its convenience, especially appealing to young parents with limited experience in choosing milk for their children. According to YouNet’s statistics, the price range below 85,000 VND is currently the best-selling price range for Meiji (based on sales volume on Shopee, Lazada, and Tiki).

Meiji attracts new customers with highly convenient cube milk products at extremely competitive prices, followed by upgrading them to canned product lines with relatively competitive pricing.

In the current market, there are few other infant formula brands offering similarly low-priced products.

YouNet ECI’s price range data also reveals that Meiji performs well in price ranges from 340,000 to 425,000 VND and 425,000 to 905,000 VND, thanks to the Growing Up Formula line for children aged 12 to 36 months.

In conclusion, Meiji has successfully implemented a pricing strategy that attracts new customers with highly convenient cube milk products at extremely competitive prices, followed by upgrading them to canned product lines with relatively competitive pricing.

II. Summary

From the perspective of e-commerce data analysis by YouNet ECI, we can summarize the growth strategies of the Meiji brand on e-commerce channels as follows:

- Product: Attracting buyers through individual stick-type milk packaging and upgrading customers through canned packaging.

- Price: Offering an attractive price point below 85,000 VND to attract new customers and maintain competitive pricing throughout usage.

- Place: Meiji is sold by top online stores on various e-commerce platforms, both official and unofficial.

- Promotion: Low-key advertising, but with a longstanding brand and reputable origin, Meiji persuades both customers and its distribution network.

About the EcomHeat platform:

EcomHeat is an online e-commerce data intelligence platform – a product of YouNet ECI.

EcomHeat automatically collects and continuously processes revenue, prices, and ratings data for over 300,000 products from 6,000+ brands available on e-commerce platforms like Shopee, Lazada, Tiki, and TikTok Shop.

By applying AI combined with in-depth data analysis, EcomHeat is the first platform in Vietnam to possess revenue and pricing data for each product model.

EcomHeat allows brands to manage market share, research competitors, and create growth strategies on e-commerce – all on one platform.

Learn more at: https://youneteci.com/eci-ecomheat-en/.

Disclaimer:

The subject of this research is not a customer of YouNet ECI and currently has no official affiliation with the organization conducting this research. The sole purpose of this research is to provide knowledge to the community. Our research topic was chosen based on its relevance to the research objectives, and all data, opinions, or conclusions drawn are based on impartial research results.